<Our Client’s Review – Wangyal v. Intact Insurance> “Hi, I am a client of the legal counsel – Ariel Baek – for the last 1 and half years. She is one of the best litigators that I have seen in my entire life so far. She is a very hardworking, consistent, polite and very positive … Read More

Ariel Baek

<Costs of examination for $20,765.25 including $19,000.00 for catastrophic determination assessments> Issue: “Is the claimant entitled to the costs of examination in the amount of $20,765.25 including $19,000.00 for catastrophic determination assessments, $1000.00 for transportation and $765.25 for interpretation services?” -1. Section 25(1)5 of the SABS stipulates that an insurer shall pay reasonable fees incurred by … Read More

<Denied chronic pain assessment and physiotherapy treatments Re-adjudicated and Overturned by the Insurance Company> 1. Our applicant’s office has met our onus successfully to prove that the two treatment plans for physiotherapy treatments and chronic pain assessment are reasonable and necessary. 2. Clinical notes and records from all treating doctors have been submitted as evidence … Read More

<Providing Notary Public Services for Ontario> Under s.3(1) of the Notaries Act, our Legal Services: (a) witness or certify, and attest, the execution of a document; (b) certify and attest a true copy of a document; (c) exercise the powers of a commissioner for taking affidavits in Ontario; and (d) exercise any other powers and … Read More

<QUALIFIED FOR Non-Earner Benefits after post-accident employment> 1. Applying the test set out in Heath v. Economical Mutual Insurance Company, 2009 ONCA 391, the Tribunal found that in the immediate post-accident period it cannot be said that the plaintiff “engaged in” most of her pre-accident homemaker and recreational activities. Pain prevented her from doing so. … Read More

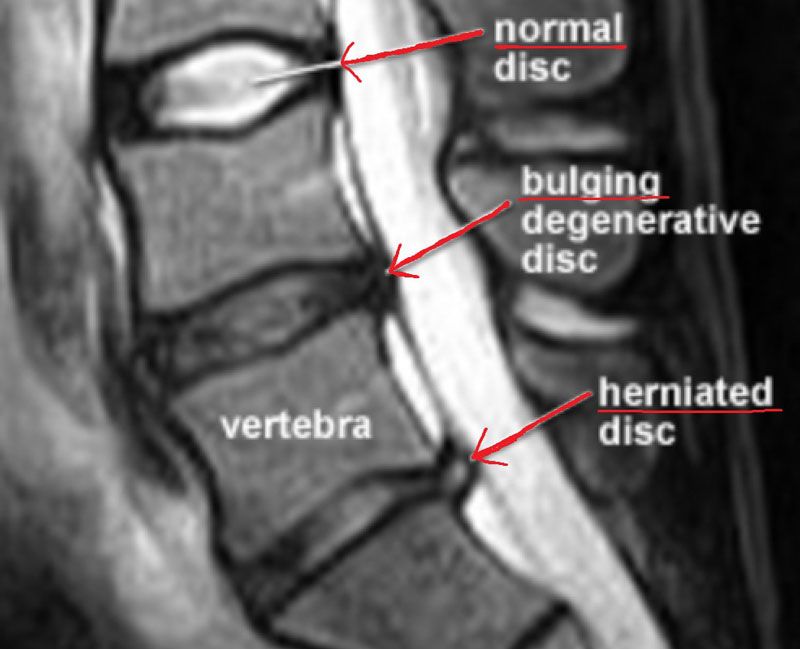

<Removal from the Minor Injury Guideline under the Schedules> 1. An insured person may be removed from the MIG if it can be established that accident-related injuries fall outside of the MIG or, under s. 18(2), that a documented pre-existing injury or condition combined with compelling medical evidence states that the condition precludes recovery if … Read More

Why do you need to understand the policy of your disability benefits insurance companies?

<Why do you need to understand the policy of your disability benefits insurance companies?> -While your disability benefits insurance companies are to pay your short-term and long-term disability benefits until you cease to be disabled, your policy contains the definition of disability and duration of your benefits. -Here are examples of how the policy of … Read More

“Total Disability” or “Totally Disabled” In the London Life Insurance Policy:

-The plaintiff, who was diagnosed as suffering from Chronic Fatigue Syndrome (“CFS”), brought an action against the insurer he was entitled to long-term disability benefits under the disability insurance policy issued by the defendant, and for punitive and aggravated damages. -The defendant did not dispute the diagnosis of CFS but took the position that the … Read More

<Taking MVA claimants’ injuries outside of Minor Injury Guideline> <thelegalservices.org/toronto/personal injury law> Mateluna v. Scottish & York, 2022 ONLAT 20-001965/AABS The applicant should discharge her evidentiary onus in establishing that she is entitled to treatment outside the Minor Injury Guideline. If s.25 Psychological Report diagnoses the applicant with adjustment disorder and specific phobia, the report … Read More

<Consequences for defective notices under s. 38(11) of the Schedules> -The consequences of a defective notice are stated in s. 38(11). -Applying that section, the insurance company is prohibited from taking the position that the applicants’ impairments fall within the MIG, and obligates the insurer to pay for the treatment plans until it gives the … Read More