When you are involved in unfortunate motor vehicle accidents, slip and falls or workplace accidents, one of our priorities is to arrange for your physical, psychological treatments to help you recover from your sustained injuries from those accidents.

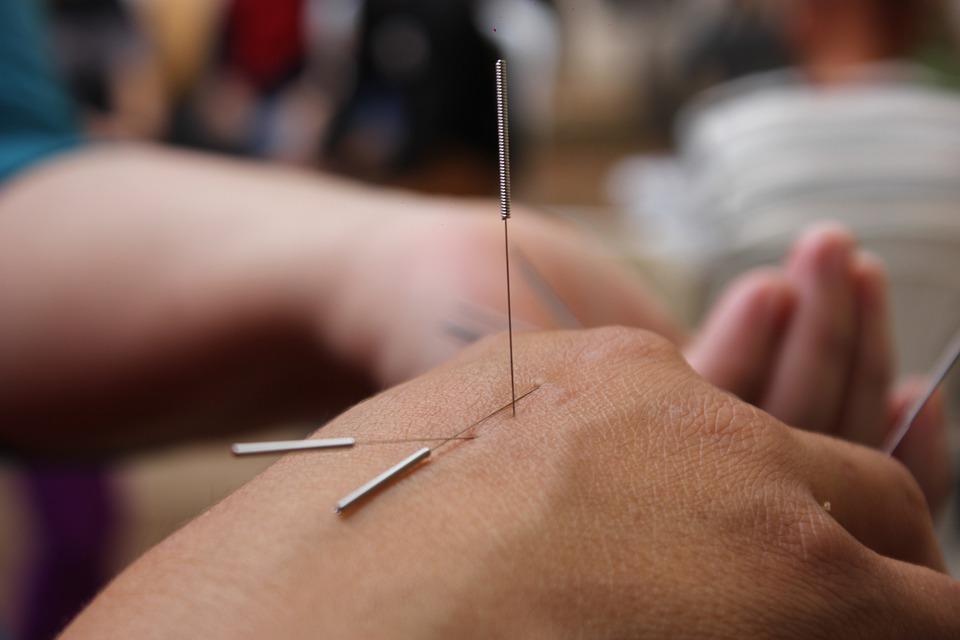

We arrange multidisciplinary treatments with medical professionals who can cater to your needs – such as, physiotherapists, chiropractors, massage therapists, occupational therapists, acupuncturists, in-home therapists, psychologists, chronic pain specialists, orthopaedic surgeons.

We will be glad to arrange the best therapists nearest your home to help you receive quality services and build your accident benefits cases from auto insurance companies. We continue to strive for your rights from the accidents to the end of your case and the following are commonly used Tribunal decisions relied on by our office:

1. P.B. vs. The Co-Operators Insurance Company 2020 ONLAT 19-008343/AABS

This case relates to section 7(1) of the SABS in which “all other income replacement assistance, if any” is deducted from the weekly IRB quantum calculated under s. 7(2). Under section 4(1), “other income replacement assistance” is defined as the amount of any gross weekly payment for loss of income that is received by or available to the person as a result of the accident under the laws of any jurisdiction or under any income continuation benefit plan. Or, it could be the amount of any gross weekly payment for loss of income, other than the following:

(i) a benefit under the Employment Insurance Act (Canada),

(ii) a payment under a sick leave plan that is available to the person but is not being received, and

(iii) a payment under a workers’ compensation law or plan that is not being received by the person because the person has elected under the workers’ compensation law or plan to bring an action and is not entitled to the payment.

The adjudicator ruled that the applicant did not receive any LTD benefits, but rather received a payout settlement for ceasing her action against Empire for denying her claim. It was ruled that this does not equate to a double recovery. As a result, LTD settlement between the applicant and Empire prohibited the Co-Operators from deducting the settlement from the applicant’s IRB quantum.

2. L.G. v Unifund, 2019 CanLII 101604 (ON LAT)

The adjudicator ruled that the cost of CAT assessments do not fall under the limits of medical, rehabilitation benefits of s. 18 of the SABS because they are not directly connected to medical benefits.

This case also relates to s. 25(1)(5) in which the insurer shall pay for reasonable fees charged for preparing an application for a determination of whether an insured person has sustained a catastrophic impairment.

3. A.L v Unica Insurance Inc., 2020 CanLII 57382 (ON LAT)

This is the Tribunal Decision where cost of A.L.’s multidisciplinary CAT impairment assessment is not to be included in the applicant’s non-CAT medical and rehabilitation benefits limits.

It was ruled that the applicant was entitled to the following portions of the multidisciplinary CAT impairment assessment plus interest under s. 51 of the SABS:

Physiatry assessment ($2,000.00); Psychology assessment ($2,000.00); Cognitive assessment ($2,000.00); Occupational Therapy assessment – in-home ($2,000.00); Occupational Therapy assessment – community ($2,000.00); Overall Assessment Summary, Analysis and Final Rating ($2,000.00); OCF-19 completion ($200.00); and OCF-18 completion ($200.00). But, the applicant’s claim for clinical file review/triage assessment ($2,000.00) was dismissed.